#Smart GenAI For Finance

Check out Demo

Generative AI-Powered AI Agents/Chatbot for Financial Services Industry

Watch this video to see how our bot automates customer service and agent operations, transforming efficiency and enhancing service delivery in financial organizations.Check out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade Bots available for Financial Services Industry powered by Google. No Setup Fees.

Empower Financial Services AI Agents/Chatbot with Generative AI & LLMs Driven Solutions

Financial institutions are embracing AI-driven virtual assistants, such as chatbots, for various roles including agent service, customer service, and employee support. With the advancements in Artificial Intelligence and Natural Language Processing, these chatbots have become smarter, providing enhanced customer experiences.

According to SmartInsights, around 60% of the global population uses social media, with an average daily usage of 2 hours and 24 minutes (2023). This highlights the importance of meeting customers on their preferred platforms.

Financial services chatbots offer a wide range of services, from credit card and loan applications to account management and fund transfers, all accessible through mobile devices or computers. The convenience and efficiency provided by these chatbots have transformed the way financial institutions operate, enabling 24/7 availability and quick responses to customer queries. Moreover, with their integration into enterprise backends, chatbots can now handle complex transactions accurately.

The advent of Generative AI in Financial Service has brought significant advancements. Unlike traditional chatbots with pre-programmed responses, Generative AI chatbots for financial service provide more dynamic and personalized interactions. They offer features such as email assistance, sentiment analysis, precise responses, and image and voice recognition, leading to increased AI Agents/Chatbot adoption rates. Traditionally, financial documents have been perceived as complex and challenging to comprehend. However, with the impressive capabilities of Large Language Models (LLMs) such as GPT, PaLM et al customers now have the advantage of receiving concise and accurate summaries that address their specific concerns. This technology has reduced the workload of employees in financial institutions, leading to enhanced operational efficiency.

The integration of Generative AI & LLMs has further enhanced the capabilities of conventional chatbots, enabling accurate responses, document comprehension, and advanced features. These chatbots not only improve customer experiences but also optimize internal processes, creating a competitive edge in the financial industry.

According to SmartInsights, around 60% of the global population uses social media, with an average daily usage of 2 hours and 24 minutes (2023). This highlights the importance of meeting customers on their preferred platforms.

Financial services chatbots offer a wide range of services, from credit card and loan applications to account management and fund transfers, all accessible through mobile devices or computers. The convenience and efficiency provided by these chatbots have transformed the way financial institutions operate, enabling 24/7 availability and quick responses to customer queries. Moreover, with their integration into enterprise backends, chatbots can now handle complex transactions accurately.

The advent of Generative AI in Financial Service has brought significant advancements. Unlike traditional chatbots with pre-programmed responses, Generative AI chatbots for financial service provide more dynamic and personalized interactions. They offer features such as email assistance, sentiment analysis, precise responses, and image and voice recognition, leading to increased AI Agents/Chatbot adoption rates. Traditionally, financial documents have been perceived as complex and challenging to comprehend. However, with the impressive capabilities of Large Language Models (LLMs) such as GPT, PaLM et al customers now have the advantage of receiving concise and accurate summaries that address their specific concerns. This technology has reduced the workload of employees in financial institutions, leading to enhanced operational efficiency.

The integration of Generative AI & LLMs has further enhanced the capabilities of conventional chatbots, enabling accurate responses, document comprehension, and advanced features. These chatbots not only improve customer experiences but also optimize internal processes, creating a competitive edge in the financial industry.

From Data to Insights: The Rise of LLMs and Generative AI in Financial Services Transformation

The financial landscape is experiencing a profound transformation as data evolves into valuable insights, facilitated by the ascent of Language Model-based Learning (LLMs) and AI technologies. This revolution is propelled by cutting-edge AI technologies such as GPT on Microsoft Azure, Watson X, AWS SageMaker, Google Gemini and more. Additionally, open-source repositories like HuggingFace, Cohere and more contribute to this wave of innovation by providing extensive features and informative insights. The blend of best-of-breed NLPs, LLMs, and AI technologies empowers financial institutions to unlock the true potential of their data, leveraging advanced analytics and natural language processing to drive strategic decision-making, enhance operational efficiency, and deliver superior customer experiences.

The AI Agents/Chatbot powered by the latest AI technologies can extract relevant information from vast financial datasets, providing precise and insightful answers to customer queries. This streamlines the query resolution process and reduces the need for human intervention with cognitive abilities.

These advanced AI-powered chatbots can automate routine tasks, such as account balance checks, fund transfers, and transactional activities. This frees up valuable time for financial institution employees, enabling them to focus on more complex and strategic tasks that require human expertise. AI technologies enable the analysis of large volumes of financial data, extracting valuable insights and trends. The conversational interfaces can generate reports, perform risk assessments, and provide data-driven recommendations for investment decisions.

The AI Agents/Chatbot powered by the latest AI technologies can extract relevant information from vast financial datasets, providing precise and insightful answers to customer queries. This streamlines the query resolution process and reduces the need for human intervention with cognitive abilities.

These advanced AI-powered chatbots can automate routine tasks, such as account balance checks, fund transfers, and transactional activities. This frees up valuable time for financial institution employees, enabling them to focus on more complex and strategic tasks that require human expertise. AI technologies enable the analysis of large volumes of financial data, extracting valuable insights and trends. The conversational interfaces can generate reports, perform risk assessments, and provide data-driven recommendations for investment decisions.

- GPT on Microsoft Azure: Unleash the power of deep learning for advanced text generation and language understanding in finance.

- Watson X: Extract actionable insights from vast financial data using machine learning, NLP, and cognitive computing.

- AWS SageMaker: Develop and deploy machine learning models for credit scoring, fraud detection, and portfolio optimization in finance.

- Google Gemini: Extract valuable information from complex financial documents using state-of-the-art language models for improved comprehension.

- HuggingFace (Open source): Access pre-trained NLP models and libraries for seamless integration of advanced capabilities into financial applications.

Streebo’s Smart Conversational Interfaces for Financial Services Powered by Latest LLMs and AI Technologies:

Streebo, a prominent AI and Digital Transformation company headquartered in Houston, Texas, is at the forefront of developing innovative intelligent chatbots that leverage advanced language models (LLMs) and AI technologies. Our advanced AI Agents/Chatbot architecture offers enterprises the flexibility to choose the NLP, LLM, and latest AI technologies that best suit their business needs. Our exceptional AI Agents/Chatbot solution utilizes cutting-edge AI technologies like GPT on Microsoft Azure, Google Gemini, Watson X, AWS SageMaker, and more. Furthermore, open-source repositories such as HuggingFace, Cohere, and others contribute to this innovative trend by providing a wide range of features and valuable insights.

Our intelligent chatbots are built on enterprise-grade cloud platforms like AWS, GCP, IBM Cloud, and Azure. They seamlessly integrate with enterprise backend systems such as EdgeVerve Finacle, Oracle FLEXCUBE Core Finance, and SAP Core Financial Services. By utilizing leading NLP engines like IBM Watson Assistant, Microsoft CLU, Copilot, Power Virtual Agents, Google Dialog Flow, and Amazon Lex, our Conversational AI for Customer Service extends the digital experience to various social media platforms with natural language interactions.

Our Financial Services AI Agents/Chatbot for Customer Service enhances the customer experience through personalization, leading to improved customer retention and increased revenue. In fact, it is estimated that leveraging chatbots and virtual assistants will save the Financial Service Industry over USD 8 billion on customer service by 2025

Our intelligent chatbots are built on enterprise-grade cloud platforms like AWS, GCP, IBM Cloud, and Azure. They seamlessly integrate with enterprise backend systems such as EdgeVerve Finacle, Oracle FLEXCUBE Core Finance, and SAP Core Financial Services. By utilizing leading NLP engines like IBM Watson Assistant, Microsoft CLU, Copilot, Power Virtual Agents, Google Dialog Flow, and Amazon Lex, our Conversational AI for Customer Service extends the digital experience to various social media platforms with natural language interactions.

Our Financial Services AI Agents/Chatbot for Customer Service enhances the customer experience through personalization, leading to improved customer retention and increased revenue. In fact, it is estimated that leveraging chatbots and virtual assistants will save the Financial Service Industry over USD 8 billion on customer service by 2025

WebApp

WebApp

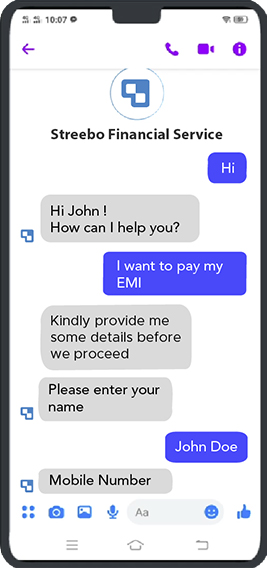

FB Messenger

FB Messenger

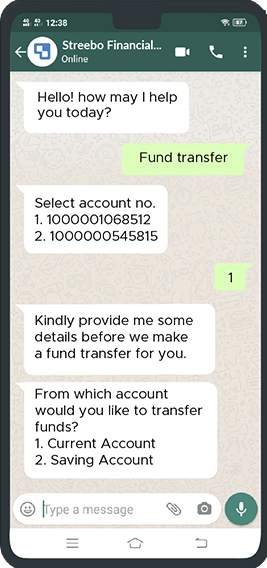

WhatsApp

WhatsApp

SMS

SMS

Business Benefits of GAI-powered Conversational Interface for Financial Services

Do You Know?

- A research report by MarketsandMarkets estimates that the global AI AI Agents/Chatbot market will grow at a compound annual growth rate (CAGR) of 29.7% between 2021 and 2026, indicating the increasing adoption and benefits of latest AI chatbots in various industries.

- Forbes’ Research shows that using smart chatbots in Financial Services can increase lead conversion rates by up to 10%.

Increased Customer Base and Revenue

AI-driven conversational interfaces enhance the digital presence of financial institutions, enabling them to reach broader audiences. This leads to an expanded customer base and ultimately drives increased revenue. Juniper’s Research indicates that businesses implementing AI chatbots experience a 20% increase in customer interactions, contributing to business growth.

Reduced Call Center Volume

Cutting-edge conversational AI chatbots come equipped with a repository of frequently asked questions (FAQs) and common website navigation queries, allowing them to handle up to 80% of Tier 1 support questions. This significantly reduces the load on call centers, improving operational efficiency. With chatbots handling routine inquiries, live agents can focus on critical issues, resulting in enhanced productivity within the customer support department.

Improved Customer Satisfaction

The availability of smart chatbots round the clock to address customer queries contributes to improved customer satisfaction. Studies show that businesses leveraging AI Agents/Chatbot technology witness higher customer retention rates, as customers appreciate the prompt and efficient assistance provided by chatbots. By leveraging advanced AI, chatbots possess comprehensive customer information, enabling them to automatically recognize and verify customers based on login credentials. This personalized approach allows chatbots to greet customers by name, communicate in their preferred language, and offer tailored recommendations and promotions, enhancing the overall customer experience.

Improved ROI

Implementing AI-powered conversational interfaces in financial institutions can lead to improved return on investment (ROI). By automating routine customer interactions and support tasks, chatbots enable businesses to optimize resource allocation and reduce operational costs. According to a study by IBM, chatbots can help businesses save up to 30% in customer support costs. Moreover, with chatbots handling a significant portion of customer inquiries, companies can allocate their human resources to more strategic and revenue-generating activities, further contributing to improved ROI. By leveraging the efficiency and cost-effectiveness of AI chatbots, financial institutions can achieve higher profitability and maximize their return on investment.

For Instance:

JPMorgan Chase, a renowned multinational financial services company, implemented “COIN,” an AI-powered AI Agents/Chatbot leveraging natural language processing to analyze legal documents. The introduction of COIN led to a substantial reduction of around 360,000 hours in the time required to review commercial loan agreements. As a result, the bank achieved significant cost savings and witnessed a marked improvement in operational efficiency.

JPMorgan Chase, a renowned multinational financial services company, implemented “COIN,” an AI-powered AI Agents/Chatbot leveraging natural language processing to analyze legal documents. The introduction of COIN led to a substantial reduction of around 360,000 hours in the time required to review commercial loan agreements. As a result, the bank achieved significant cost savings and witnessed a marked improvement in operational efficiency.

Exploring the Game-Changing Use-Cases of Our Financial Service chatbots:

- Personal Financial Assistant: Our chatbots, driven by Generative AI, serve as personalized financial assistants, providing users with real-time financial guidance and advice.

- Account Management: Our Finance Cognitive Assistants proficiently handle diverse account-related tasks, such as balance inquiries, transaction history checks, and personal information updates. According to a Statista survey, 58% of consumers express comfort in utilizing chatbots for basic banking transactions.

- Loan Applications and Mortgage Assistance: It is projected that chatbots can reduce loan approval times by up to 75%. Our financial virtual assistants streamline the loan application process, providing users with a convenient and efficient means of applying for loans.

- Investment Advice and Portfolio Management: Equipped with AI capabilities, our chatbots offer personalized investment advice tailored to user preferences and risk tolerance. They also facilitate portfolio management and rebalancing.

- Customer Support and Query Resolution: AI-powered conversational interfaces efficiently handle customer inquiries, delivering instant support and minimizing the need for customers to wait for assistance.

Our AI Powered Customer Service AI Agents/Chatbot For Financial Services Offers The Below Features

Drive Business Growth using Pre-Trained Smart chatbots

- Trained until 99% Accurate

- Pay-Per-Usage

Streebo’s Pre-Trained Voice & Chat Bot for Financial Services Customer Service is Trained in the Following Operations

FAQs (Frequently Asked Questions)

FAQs (Frequently Asked Questions) Branch Locator

Branch Locator Generate a Statement

Generate a Statement Apply for a loan/credit card

Apply for a loan/credit card Report a lost/block my card

Report a lost/block my card Manage Service Request

Manage Service Request Customer Support & Query Resolution

Customer Support & Query Resolution Customer Support & Query Resolution

Customer Support & Query Resolution Loan Account Management

Loan Account Management Loan Management

Loan Management Fund Transfer

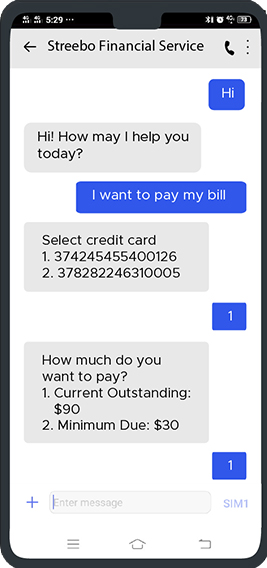

Fund Transfer Bill Payment/Repayment Transactions

Bill Payment/Repayment Transactions Update Profile

Update Profile Update Profile

Update Profile Product Recommendations

Product Recommendations Feedbacks and Reviews

Feedbacks and Reviews Offers and Promotions

Offers and PromotionsWhy Choose Us

AI Expertise

AI ExpertiseWe have a team of experts who are well-versed in the latest AI technologies, including Google Gemini, Watson X, AWS SageMaker, GPT, open-source models at HuggingFace and more. With their deep understanding and proficiency in these technologies, we can provide cutting-edge solutions and strategic consultation to our clients.

Omni-Channel Experience

Omni-Channel ExperienceOur AI Powered Customer Support AI Agents/Chatbot for Financial Services can be deployed across social media channels such as FB Messenger, WhatsApp, Signals, WeChat, Skype, SMS and even Email. Our smart bots can even be deployed to existing digital properties such as the website and mobile App.

We specialize in advanced NLP engines such as IBM Watson, Amazon LEX, Microsoft CLU, Copilot, Power Virtual Agents, Google DialogFlow, and Meta from Wit.AI. Our AI Agents/Chatbot can comprehend and analyze financial language with precision, enabling it to handle tasks such as financial document understanding, and investment recommendations with great accuracy.

Personalized Financial Solutions

Personalized Financial SolutionsFinancial needs vary from individual to individual and business to business. Our expertise in AI technologies empowers us to create personalized financial AI Agents/Chatbot solutions. By working closely with you, we tailor the chatbot’s capabilities to align with your specific requirements, providing a highly customized and relevant user experience. among others.

Seamless Integration

Seamless IntegrationOur financial AI Agents/Chatbot solutions are designed for seamless integration with existing financial systems and platforms. Whether it’s integrating with banking APIs, CRM software, or wealth management platforms, we ensure smooth interoperability, enabling a cohesive user experience and streamlined operations. They come pre-integrated with Core Financial Solutions such as Edgeverve Finacle Oracle FLEXCUBE Core Finance, and SAP Core Financial Services among others.

Flexible Deployment Options

Flexible Deployment OptionsOur pre-trained chatbots for Financial Services can be deployed on-premises or on IBM Cloud, Microsoft Azure, Amazon AWS, or Google Cloud Platform.

Our AI Agents/Chatbot now leverages cutting-edge algorithms to classify and categorize unstructured data, enabling seamless organization and retrieval of information. Users can now effortlessly access relevant financial data such as invoices, receipts, and statements, empowering them with quick and accurate insights for better financial decision-making.

Multi-modal Capabilities

Multi-modal CapabilitiesWhether it’s analyzing bank statements, interpreting visual data, or providing voice-based account updates, our multi-modal financial AI Agents/Chatbot can deliver a seamless and comprehensive user experience across different channels.

Innovation and Future-readiness

Innovation and Future-readinessWe stay at the forefront of AI research and development, continuously exploring new advancements in AI technologies and techniques. By partnering with us, you gain access to the latest innovations, ensuring your financial AI Agents/Chatbot remains up-to-date and capable of delivering cutting-edge solutions to meet evolving customer needs.

Pricing Options

Capex Option

You can choose to buy the product with an upfront amount

You can choose to buy the product with an upfront amountOpex Option

You can choose to Subscribe to the MVP Bot for a fixed monthly charge.

You can choose to Subscribe to the MVP Bot for a fixed monthly charge.Pay Per Usage

This is a conversation-based subscription and is tied to the number of conversations & messages the AI Agents/Chatbot handles. Thus, you only pay if the AI Agents/Chatbot is getting used and is actually deflecting calls.

This is a conversation-based subscription and is tied to the number of conversations & messages the AI Agents/Chatbot handles. Thus, you only pay if the AI Agents/Chatbot is getting used and is actually deflecting calls. Not sure where to begin? Explore our Bot Store and let us guide you through the possibilities! Dive into demos of our advanced bots and see how they can transform your financial operations. Start your journey to innovation today!

Success in Action : Case Study

Learn how a leading financial institution in the Middle East streamlined their customer services and enhanced the customer experience using Streebo’s Gen AI-Powered Voice Assistant/Voice chatbot. Discover how they efficiently resolved customer queries, improving their service by 28 basis points.

A well-known financial institution based in the Middle East struggled with managing a high volume of queries from customers with diverse linguistic backgrounds. READ MORE