#Smart GenAI For Bot

Check out Demo

AI Powered chatbot for Healthcare Insurance

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Trusted by hundreds of leading companies

×

Check out the Enterprise Grade Bots Powered by Gen AI. No Setup Fees.

Empowering Customers: The Game-Changing Role of WhatsApp chatbots in Health Insurance

In the modern age of technology, the way we access business services has been completely transformed and the healthcare insurance sector is no exception. Health insurance plays a vital role in safeguarding our finances during unexpected medical situations. But comprehending health policies complexities, inquiring about claims settlements, exploring coverage options and effectively understanding terminologies can be a daunting task for the customers. Similarly, health insurance industries are also encountering challenges in attracting and retaining customers due to prolonged waiting times.

Each day, insurers are inundated with countless inquiries regarding policy terms, account updates, claims processing, and more. Due to intensified competition, delivering quality customer experiences and effectively conveying the value to every individual becomes a formidable task, due to customer support team’s limited capacity to handle inquiries simultaneously. As a result, customers frequently experience long waiting times, which in turn accelerates the likelihood of potential prospects and existing customers either abandoning their queries or transitioning to competing companies.

Each day, insurers are inundated with countless inquiries regarding policy terms, account updates, claims processing, and more. Due to intensified competition, delivering quality customer experiences and effectively conveying the value to every individual becomes a formidable task, due to customer support team’s limited capacity to handle inquiries simultaneously. As a result, customers frequently experience long waiting times, which in turn accelerates the likelihood of potential prospects and existing customers either abandoning their queries or transitioning to competing companies.

To address these issues, insurers are increasingly integrating WhatsApp chatbots into their operations to streamline the customer experience and automate various service offerings. Leveraging the widespread use of WhatsApp among both customers and agents, implementing WhatsApp chatbots in the insurance sector can have a transformative impact on enhancing the overall customer experience. Let’s explore the ways in which this can be achieved.

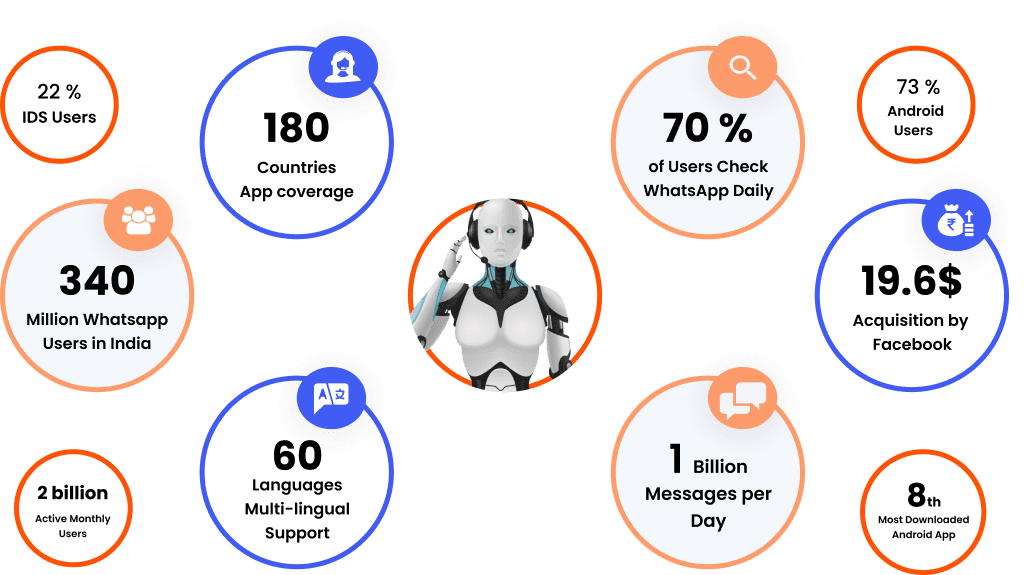

Unveiling the Potential of WhatsApp chatbot for Health Insurance

The statistics highlight the potential of WhatsApp as a platform to reach wider audiences and deliver quality services at lightning speed. By leveraging AI, NLP and ML, WhatsApp bots are intelligent virtual assistants that are transforming the health insurance sector and propelling them towards a digital and customer-centric future. Imagine having an AI-powered conversational assistant on WhatsApp available 24/7, capable of answering your insurance queries and providing real-time assistance.

Well, that’s precisely what a WhatsApp chatbot of a health insurance company offers. By leveraging these next-gen smart virtual assistants on WhatsApp (one of the most used messaging apps) health insurance companies can give a boost to customer engagement, streamline support, expedite claims processing, and achieve cost savings.

Gen AI-powered Health Insurance Virtual Assistant on WhatsApp

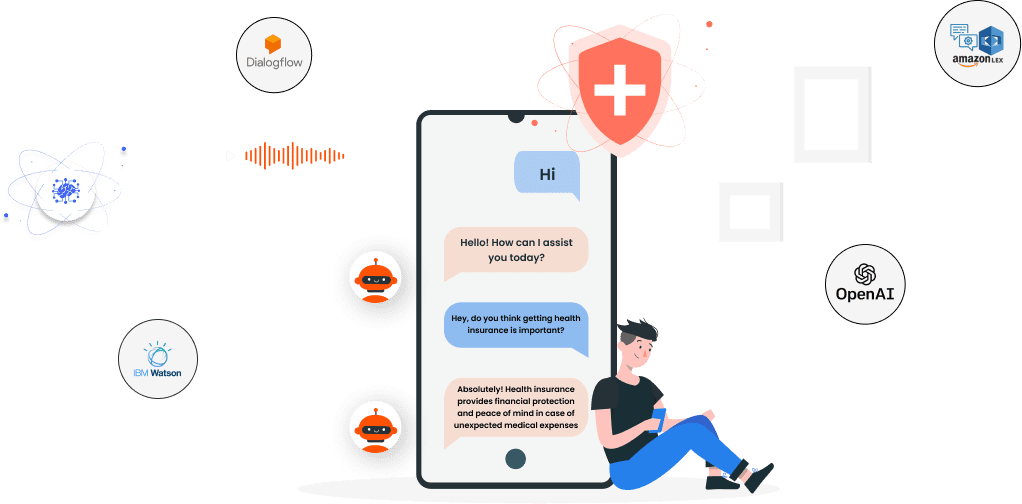

Streebo, an AI and digital transformation company, has developed a range of chatbots that support text, voice, and chat commands. As a prominent provider of Gen AI development services, our company specializes in delivering tailor-made solutions that leverage state-of-the-art OpenAI models, including GPT on Microsoft Azure, Bard from Google, Amazon BedRock, IBM WatsonX, and HuggingFace.

By harnessing cutting-edge technologies like Machine Learning (ML), Language Models (LLMs), and top-tier Natural Language Processing (NLPs)- IBM Watson, Microsoft CLU, Copilot, Power Virtual Agents, Amazon Lex, Google DialogFlow, and Wit.AI from Meta, our intelligent chatbots on WhatsApp enable businesses to expedite the accomplishment of their AI goals.

By harnessing cutting-edge technologies like Machine Learning (ML), Language Models (LLMs), and top-tier Natural Language Processing (NLPs)- IBM Watson, Microsoft CLU, Copilot, Power Virtual Agents, Amazon Lex, Google DialogFlow, and Wit.AI from Meta, our intelligent chatbots on WhatsApp enable businesses to expedite the accomplishment of their AI goals.

Utilizing the GPT-capabilities, our chatbots for health insurance offer a distinct conversational capability that closely mimics human interaction. Furthermore, our smart pre-trained chatbots have been specifically developed with remarkable context-switching functionalities, enabling them to effectively address intricate subjects and handle queries that involve managing multiple dialogue elements on WhatsApp.

This ensures a smooth transition between different conversation topics, making them well-suited for managing complex tasks. To ensure optimal performance, our chatbots undergo rigorous training until they achieve a remarkable 99% accuracy level. They are pre-integrated to cater to various customer use cases related to the operations. Additionally, they seamlessly integrate with diverse enterprise backends and ERP systems like SAP, JD Edwards, Oracle, as well as customer relationship management systems such as Salesforce or SugarCRM.

This ensures a smooth transition between different conversation topics, making them well-suited for managing complex tasks. To ensure optimal performance, our chatbots undergo rigorous training until they achieve a remarkable 99% accuracy level. They are pre-integrated to cater to various customer use cases related to the operations. Additionally, they seamlessly integrate with diverse enterprise backends and ERP systems like SAP, JD Edwards, Oracle, as well as customer relationship management systems such as Salesforce or SugarCRM.

Top Use Cases of Our WhatsApp chatbot for Health Insurance Customer Sector

Policy Information

According to a survey by Accenture, 73% of consumers prefer to interact with insurance companies through digital channels like WhatsApp. With our GPT powered WhatsApp chatbots, customers can inquire about their policy details, coverage benefits, claim status, premium deadlines and renewal dates – all through simply typing a message to the bot on WhatsApp. This eliminates the need for waiting times on calls with customer care representatives.

Claims Assistance

Health insurance virtual assistant on WhatsApp automates the procedures of claims processing providing the instructions on claim initiation, required documents, and tracking claim status. This ensures a seamless and transparent experience for customers during the claims journey.

Policy Management

Customers can make use of GPT-like WhatsApp chatbot to manage their policies. From selecting the right policy, modifying existing policy to submitting policy documents, everything can be done accurately at a faster pace, ensuring convenience to the customers. A study by PwC states that 75% of healthcare consumers would use digital solutions, like chatbots, for administrative tasks like claims processing or policy management services.

Frequently Asked Questions (FAQs)

Health insurance virtual assistant on WhatsApp automates the procedures of claims processing providing the instructions on claim initiation, required documents, and tracking claim status. This ensures a seamless and transparent experience for customers during the claims journey.

Research by IBM shows that chatbots can answer up to 80% of routine questions, reducing the workload on customer support teams.

Research by IBM shows that chatbots can answer up to 80% of routine questions, reducing the workload on customer support teams.

Troubleshooting and Technical Support

The chatbot has the capability to aid customers in resolving technical challenges associated with accessing online portals, completing premium payments, or utilizing mobile applications. It can provide systematic guidance or, if required, escalate the matter to a support representative for further assistance.

Top Use Cases of WhatsApp chatbot for Health Insurance Marketing & Sales Sector

Personalized Recommendations & Promotional Campaigns

Gen AI WhatsApp chatbots for health insurance can send customers notifications about new policies or services launched based on customers’ interest and purchase history. This helps the marketing team in targeting the right products to the right customers. By sharing promotional offers, discounts, and updates on new insurance products or services with customers, WhatsApp bots can reach wider audiences and can have more conversions.

A report by Twilio indicates that WhatsApp has a 98% open rate for messages, making it an effective channel for delivering marketing communications.

Lead Generation & Qualification

AI-powered Conversational Interfaces on WhatsApp can generate new leads for health insurance industries through chatbot interface. The implementation of a WhatsApp chatbot for insurance provides a convenient and expeditious method of generating sales leads by gathering vital customer details like name, phone number, email, and more. This not only sustains the interest of potential customers but also imparts knowledge regarding insurance requirements and advantages, ultimately enhancing the probability of converting them into valuable leads.

According to HubSpot, Health insurance industries that use WhatsApp chatbots for lead generation see a 48% increase in revenue.

According to HubSpot, Health insurance industries that use WhatsApp chatbots for lead generation see a 48% increase in revenue.

Quote Generation

By utilizing customer inputs such as age, medical history, and coverage preferences, the chatbot has the capability to swiftly generate insurance quotes. This accelerates the quoting process and empowers the sales team to efficiently pursue interested prospects through prompt follow-up actions.

Key Benefits of using Health Insurance Virtual Assistant on WhatsApp

Improved Customer Engagement

Deploying health insurance chatbots on WhatsApp improve customer engagement by providing accurate responses to their queries promptly. Understanding complex documents of policies and managing become extremely seamless with these smart chatbots. This leads to 40% and more surge in customer satisfaction and retention index.

Instant Assistance, Anytime, anywher

According to a study by Salesforce, 64% of customers expect insurance companies to respond to inquiries in real-time. With these customers get real-time assistance 24/7. Whether customers have questions about their policy coverage,premium payments, or need guidance on claims, the chatbot is just a message away. This instant access ensures customers feel supported and well-informed at all times.

Increased ROI

WhatsApp chatbots in health insurance companies can significantly increase ROI. Research shows that it can lead to a 3x increase in ROI within a year (IBM). By automating processes, improving customer interactions, and reducing operational costs, WhatsApp bot prove to be a valuable investment for health insurance companies.

Instant Assistance, Anytime, anywher

According to Deloitte, a majority of consumers (60%) perceive companies utilizing chatbots as being at the forefront of technology. By integrating WhatsApp chatbots, health insurance companies can distinguish themselves from competitors and elevate their brand perception among customers.

Features and Functionalities of Gen AI WhatsApp chatbot Capabilities for Health Insurance Companies

-

Voice & chat activated

Voice & chat activated -

OmniChannel

OmniChannel -

Trained until 99% Accurate

Trained until 99% Accurate -

Advance Analytics

Advance Analytics -

Secure

Secure -

Multi-lingual

Multi-lingual

-

Pre-integrated with backends

Pre-integrated with backends -

Flexible deployment models

Flexible deployment models -

Access to unstructured data

Access to unstructured data -

Multi-modal capabilities

Multi-modal capabilities -

Live-agent Support

Live-agent Support

Conclusion

Overall, implementation of WhatsApp chatbots have become a necessity from a key differentiator for health insurance companies. Staying in line with current trends and technological advancements is essential to stay ahead in the curve. Health insurance companies that have embraced chatbots for their customer & market services have witnessed significant improvements in sales conversions and customer satisfaction, resulting in improved ROI. According to McKinsey, health insurance providers that have launched WhatsApp bots experienced an impressive 30% reduction in customer support costs, attributed to the chatbots’ ability to handle a high volume of inquiries simultaneously.

By strategically investing in AI-powered WhatsApp chatbots for health insurance, businesses can significantly increase their chatbot adoption index. The importance lies in avoiding the pitfalls of vague and ineffective chatbots that can become liabilities rather than assets. With a well-designed and intelligent chatbot solution powered by leading NLPs, LLMs, and Generative AI,insurers can enhance customer experiences, streamline insurance processes, and ultimately drive better outcomes. This prudent investment ensures that the it becomes a valuable tool, empowering both customers and insurance providers in the ever-evolving healthcare landscape.

Don’t miss out on the game-changing potential of chatbots—embrace innovation and thrive in the ever-changing health insurance landscape!

Don’t miss out on the game-changing potential of chatbots—embrace innovation and thrive in the ever-changing health insurance landscape!

Pricing Options

Capex Option

You can choose to buy the Bot solution.

Opex Option

You can choose to Subscribe to tour Bot solution for a fixed monthly charge

Pay Per Usage

This is a conversation-based subscription and tied to the number of conversations & messages the bot handles. Thus, you only pay if the Bot is getting used and is actually deflecting calls.

So, what are you waiting for?

Get in touch with us now to discover more about We can fuel the growth of your enterprise!Schedule your demo today!!