Corporate Banking at Your Fingertips: How Gen AI Bots Revolutionize Customer Experience

i want to transfer funds $5500 to Jenna Ortega

Jenna Ortega | HSBC Bank

Acc No: 850960690394

IFSC: HSBC7890

Acc No: 850960690394

IFSC: HSBC7890

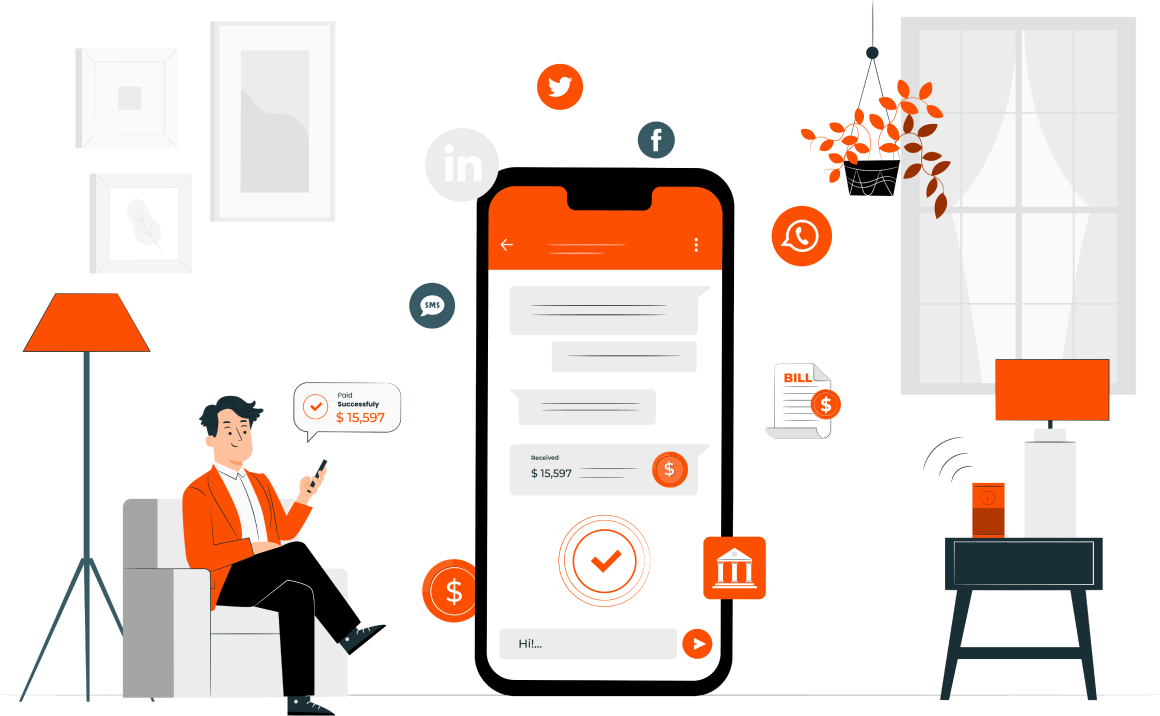

Channels of Convenience: Banking Anywhere, Anytime

Imagine a world where your banking operations are not tied down by the medium of access. Whether

it’s through a web application offering a rich interface for detailed banking activities or a

mobile app that brings banking to your fingertips, the possibilities are endless. WhatsApp and

SMS services break down the barriers further, ensuring that banking is accessible even on the

move or in the simplest of interfaces.

Web applications,

providing a comprehensive banking interface.

Web applications,

providing a comprehensive banking interface.

Mobile applications,

for banking on the go.

Mobile applications,

for banking on the go.

WhatsApp,

merging banking with the world’s most popular messaging platform.

WhatsApp,

merging banking with the world’s most popular messaging platform.

SMS,

ensuring basic banking services are accessible even without internet connectivity.

SMS,

ensuring basic banking services are accessible even without internet connectivity.

pay my land line bill

Sure! Please select your

payment Mode.

payment Mode.

Credit Card

Net banking

Credit Card

Sure! Please select your saved

Credit card to continue with.

Credit card to continue with.

293801540567

898590637884

898590637884

The integration of AI bots across multiple channels signifies a leap towards unparalleled

accessibility in corporate banking. Businesses can interact with these bots via:

This multi-channel approach ensures that corporate banking services are just a few clicks away, regardless of the medium.

This multi-channel approach ensures that corporate banking services are just a few clicks away, regardless of the medium.

Transformative Features and Modules: A Closer Look

AI bots are equipped with a suite of features aimed at simplifying corporate banking. They

handle FAQs, engage in transactional use cases like fund transfers and foreign exchange, and

offer advanced functionalities such as

I want to apply for a car

I want to apply for a car loan.

Hi there, How can i help

you today?

you today?

Omni-channel solutions, ensuring a consistent experience across all

platforms.

Omni-channel solutions, ensuring a consistent experience across all

platforms.

User-based login authorization and email integration

for secure and personalized access.

User-based login authorization and email integration

for secure and personalized access.

Multilingual support, breaking down language barriers.

Multilingual support, breaking down language barriers.

Speech to text/text to speech capabilities, enhancing accessibility.

Speech to text/text to speech capabilities, enhancing accessibility.

Dynamic PDF generation and PII masking for secure and

convenient documentation.

Dynamic PDF generation and PII masking for secure and

convenient documentation.

Analytics, providing insights into user interactions and bot

performance.

Analytics, providing insights into user interactions and bot

performance.

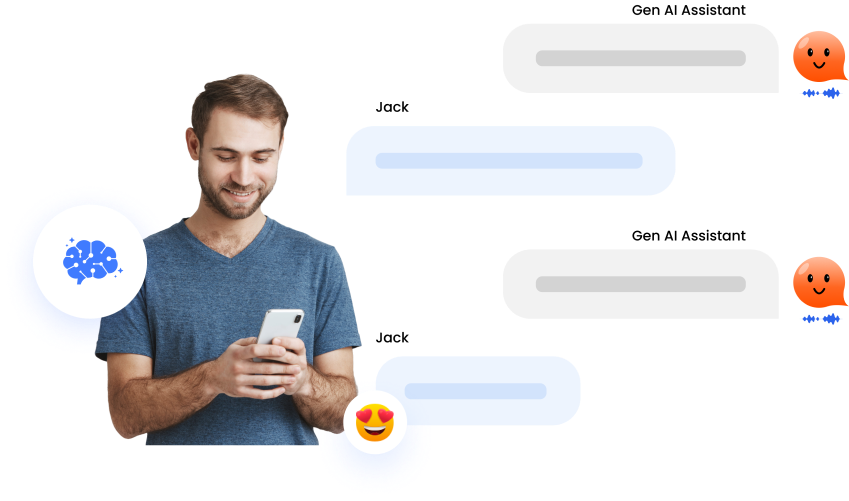

Through the Lens of Real-World Scenarios: Jack’s Journey with Generative AI Banking Bots

The real value of AI banking bots shines through in their application.

The transformative power of AI banking bots is best illustrated through the day-to-day banking

activities of Jack, a fictional corporate banking client. His interactions with the bot across

different scenarios showcase not just the versatility of these digital assistants but also their

profound impact on streamlining corporate banking tasks.

Scenario 1: Managing Foreign Payments

On a busy Monday morning, Jack is preparing to clear several invoices for his company,

including one from an overseas vendor. He logs into the corporate banking web

application from his laptop and is greeted by the AI bot.

The bot guides Jack through the exchange process, displaying the current exchange rate and the transaction fee, which stands at a competitive 1.2%. Jack appreciates the transparency and efficiency of the process, completing the transaction in just a few clicks.

The bot guides Jack through the exchange process, displaying the current exchange rate and the transaction fee, which stands at a competitive 1.2%. Jack appreciates the transparency and efficiency of the process, completing the transaction in just a few clicks.

Good Morning, Jack! How can i

assist you today?

assist you today?

I need to pay an invoice in euros.

Can i do that directly?

Can i do that directly?

Absolutely, Jack. Your account

supports payments in over 138

currencies, including euros.

supports payments in over 138

currencies, including euros.

Would you like to proceed with a

currency exchange first?

currency exchange first?

Yes, Please.

Scenario 2: Adding a New Vendor on the Go

Later in the week, Jack finds himself in a taxi, rushing between meetings, when he

remembers an urgent payment that needs to be processed to a new vendor. He pulls out his

smartphone and opens the mobile banking application. The AI bot instantly recognizes

him.

Jack inputs the required information, and within moments, the bot confirms the addition of the new payee. Jack is impressed by the convenience, allowing him to manage his responsibilities without skipping a beat.

Jack inputs the required information, and within moments, the bot confirms the addition of the new payee. Jack is impressed by the convenience, allowing him to manage his responsibilities without skipping a beat.

Welcome back, Jack. How can i help

you during your ride today?

you during your ride today?

I need to add a new payee

for a payment.

for a payment.

Sure thing. Please provide me

with the payee’s name and

account details.

with the payee’s name and

account details.

Name: Andre Barbara

AC No: 8930955893023

AC No: 8930955893023

Alright! Please enter OTP sent to

your registered mobile number.

your registered mobile number.

Scenario 3: Quick Checks and Transactions via SMS

While in a meeting, Jack receives a notification on his phone indicating that a payment

has been successfully processed. Curious about his current account balance and wanting

to review recent transactions without interrupting the meeting, Jack discreetly sends an

SMS to the banking bot.

Jack replies “Yes,” and within seconds, he receives a succinct summary of recent transactions, confirming the payment made earlier. This discreet interaction via SMS exemplifies the bot’s capability to provide swift banking support without the need for a smartphone app or computer.

Jack replies “Yes,” and within seconds, he receives a succinct summary of recent transactions, confirming the payment made earlier. This discreet interaction via SMS exemplifies the bot’s capability to provide swift banking support without the need for a smartphone app or computer.

check account balance.

Sure! Please enter last 4 digit of your

registered mobile Number.

registered mobile Number.

7006

Please enter OTP sent to your

registered mobile Number.

registered mobile Number.

518802

Your current balance is $16909.39.

Do you need a detailed transaction

history?

Do you need a detailed transaction

history?

Scenario 4: Verifying Payroll Processing Capabilities via WhatsApp

On his way back from the meeting, Jack receives a query from his finance team about the

company’s payroll processing capabilities and associated fees. He decides to use

WhatsApp this time, sending a message to the bank’s WhatsApp number.

The bot not only confirms the capability but also offers to provide step-by-step guidance, showcasing the depth of support available across various channels.

The bot not only confirms the capability but also offers to provide step-by-step guidance, showcasing the depth of support available across various channels.

Can we process payroll

directly through our account?

directly through our account?

Yes, Jack. Customers with current

checking accounts can utilize our

integrated payroll system without

any processing fee.

checking accounts can utilize our

integrated payroll system without

any processing fee.

Would you like a guide on

how to set this up?

how to set this up?

Yes, please.

The Impact of AI Banking Bots on Jack’s Banking Experience

Through these scenarios, Jack experiences firsthand the efficiency, flexibility, and convenience

offered by AI banking bots. From executing foreign currency transactions and adding payees on

the go to conducting quick checks via SMS and seeking information through WhatsApp, the bot has

significantly simplified his banking tasks.

This seamless integration of AI into everyday banking not only saves time but also ensures that

Jack can focus on his business, confident that his banking needs are being managed effectively

and securely.

These real-world applications of AI banking bots highlight their ability to adapt to various situations and customer needs, proving that the future of corporate banking is not only digital but also intelligently responsive to the demands of modern business.

These real-world applications of AI banking bots highlight their ability to adapt to various situations and customer needs, proving that the future of corporate banking is not only digital but also intelligently responsive to the demands of modern business.

Let’s understand how banking bots are affecting daily numbers in terms of benefits experienced by businesses

Operational Cost Reduction

Operational Cost Reduction

Businesses see up to a 30% cost saving in customer service after

adopting AI banking bots.

– McKinsey & Company

– McKinsey & Company

Faster Response Times

Faster Response Times

Introduction of banking bots leads to an 80% improvement in customer inquiry

response times.

– Forbes

– Forbes

Transaction Volume Increase

Transaction Volume Increase

Banking bots enable a 40% rise in transaction volumes by offering

24/7 services.

– Deloitte

– Deloitte

Accuracy and Compliance

Accuracy and Compliance

Accuracy in transactions and compliance improves by 50% with banking

bots.

– PwC

– PwC

Higher Customer Satisfaction

Higher Customer Satisfaction

Use of banking bots results in a 20% increase in customer satisfaction.

– Gartner

– Gartner

New Customer Growth

New Customer Growth

AI banking solutions contribute to a 25% increase in new customer

acquisitions.

– Accenture

– Accenture

Conclusion: A Leap Towards Smarter Corporate Banking

In today’s fast-paced world, everyone is incredibly busy, with little time or patience to

navigate through the complex menus or interfaces of online banking. The thought of physically

visiting a bank is even more daunting. In this context, Generative AI banking bots have been a

game-changer, significantly simplifying our lives as customers. Now, we can effortlessly manage

our finances anytime and anywhere, without having to deal with the intricacies of traditional

banking systems or the inconvenience of bank visits.

By automating routine transactions and providing instant access to banking services across

multiple channels, these bots have not only saved time but also enhanced the overall banking

experience for corporate clients. As we move forward, the integration of AI into corporate

banking is expected to continue evolving, driving innovations that will further simplify and

enrich the world of corporate finance.

Pricing Options

Capex Option

Capex OptionYou can choose to buy the product with an upfront amount.

Opex Option

Opex OptionYou can choose to Subscribe to the MVP Bot for a fixed monthly charge.

Pay Per Usage

Pay Per UsageThis is a conversation-based subscription and is tied to the number of conversations & messages the bot handles. Thus, you only pay if the Bot is getting used and is actually deflecting calls.

Engage, Convert, and Grow!

Start Your 30-Day Free Trial

Don’t miss this opportunity to elevate your banking services and set a new standard for customer interaction.

Begin your journey towards banking excellence with smart Generative AI-powered solution.

Don’t miss this opportunity to elevate your banking services and set a new standard for customer interaction.

Begin your journey towards banking excellence with smart Generative AI-powered solution.