Generative AI Powered Smart Bot Solution

Omni-Channel Bots – Deploy on Chat, Voice, Email, Instagram, Facebook, WhatsApp and Even SMSCheck out Demo

Check out the Enterprise Grade Bots Powered by Gen AI. No Setup Fees.

Generative AI-Powered chatbots for Banking on Instagram: The New Face of Banking

In the Instagram age, it’s not just influencers and lifestyle brands that are thriving on the platform. The banking industry has also not been exempted from the rapid rate of advancements in technology. The rise of Generative AI-powered banking chatbots is one of the most intriguing trends in this field. In order to offer their consumers flawless financial services, banking institutions are also utilizing the power of Gen AI technology while leveraging the popularity of social media platforms like Instagram. These sophisticated virtual assistants are revolutionizing how customers communicate with their banks, resulting in more effective and convenient financial services than ever before. In this article, we’ll explore the remarkable influence of these Gen AI-driven Instagram chatbots on BFSI sector along with some persuasive data to support our findings.

In this article, we’ll explore the remarkable influence of these Gen AI-driven Instagram chatbots on BFSI sector along with some persuasive data to support our findings.

The Rise of Gen AI-Powered Banking Instagram chatbots: Why do banks need Instagram chatbots?

In today’s business landscape, it’s imperative for all banking and financial institutions to build a presence on Instagram and start leveraging the platform to build brand awareness. With over 1 billion monthly active users, Instagram attracts a predominantly youth audience, with 71% under 35 years old. Banks can benefit from integrating chatbots on Instagram to engage this demographic in real-time and streamline customer support.

- Instagram has 500+ million daily active users (DAUs) globally

- In the US, 75% of people aged 18-24use Instagram making up the largest group by age, followed by 57% of 25–30-year-olds.

- Users spend an average of 28 minutes per day on Instagram globally. That number can get split down into users under aged under 25 years spend an average of 32 minutes per day on the app, while users over the age of 25 spend an average of 24 minutes per day using the app.

Entry of Generative AI: The Time is Now

Generative AI has emerged as a transformative force in the digital evolution of banking, especially banking chatbots on Instagram.The remarkable growth trajectory of Generative AI within the banking sector is evident in the numbers. The AI in Banking Market was valued at USD 5.13 Billion in 2021 and is projected to surge to USD 64.03 Billion by 2030, boasting an impressive CAGR of 32.36% from 2023 to 2030. This growth underscores the industry’s recognition of Gen AI’s transformative potential.

Generative AI powered Banking

chatbots on Instagram

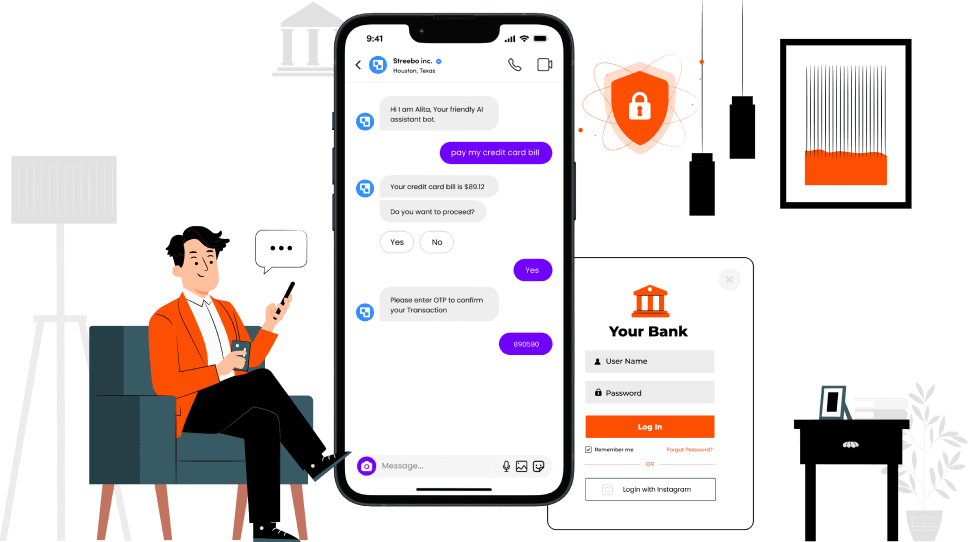

As a renowned AI and digital transformation company, we have built an arsenal of highly advanced intelligent chatbots. Our expertise extends to the world of banking, where we’ve harnessed the power of Generative AI for our Instagram-based banking chatbots.

Our chatbot architecture is designed to provide organizations with unparalleled flexibility. We offer a wide range of natural language processing (NLP) techniques, language models (LLMs), and AI technologies. Leveraging cutting-edge AI tools like GPT on Microsoft Azure, Google Gemini, Watsonx, AWS SageMaker, Amazon BedRock, open-source models on HuggingFace, and more, our chatbot solution stands out for its exceptional performance.

Pain-Points/Challenges of Banking Industry

and their Insta-Solutions

The banking industry faces several pain points, and Our Banking chatbots on Instagram can help address some of these challenges effectively:

Many customers lack financial literacy. Our chatbots can provide educational content and answer questions, helping customers make informed financial decisions on Instagram. Long Customer Service Wait Times

Traditional ways of banking customer service can lead to long waiting times. Our banking chatbots on Instagram deliver quick responses, reducing wait times and improving customer satisfaction. High Operational Costs

Upkeep of physical branches and call centers can be expensive. Our Generative AI powered Instagram chatbots for banking offer a cost-effective way to handle routine inquiries and transactions. Lack of 24/7 Support

In traditional setup, banks have limited customer service hours. But our chatbots for banks provide round-the-clock support, ensuring that customers can get assistance seamlessly whenever they need it. Monetary Transaction Accuracy and Reliability

Monetary and transactional operations must be precise in banking. Errors in interpreting messages and initiating transactions can lead to customer dissatisfaction and potential financial loss. Our Instagram banking chatbots are designed with advanced natural language processing (NLP) and Generative AI capabilities to accurately interpret user messages and conduct transactions with precision. Additionally, they can implement multiple layers of authentication and confirmation to ensure the reliability and security of monetary transactions, reducing the risk of errors and customer loss. Language Barriers

Banks serving diverse customer bases may face language barriers. Our chatbots can offer multilingual support, improving accessibility for non-native speakers. Difficulty in Finding Information

Locating specific information on a bank’s website or app can be challenging. Our chatbots for banking can quickly direct users to the relevant information they need on Instagram. Ineffective Marketing

Banks often struggle with engaging younger audiences. Leveraging chatbots help to connect with younger demographics who are spending most of their time on Instagram and deliver targeted marketing content.

Top Use Cases of Banking chatbots on Instagram

By informing customers about various financial services and products, chatbots can speed up knowledge transmission on the Instagram platform.

Banks can utilize chatbots to instantly update followers on new policies, brand-new products, and significant announcements.

By providing updates on account activity, transaction history, and financial notifications, chatbots assist banks by raising consumer awareness.

chatbots offer bite-sized financial tutorials, empowering users with knowledge about budgeting, investing, and financial planning.

Through Instagram chatbots, users can receive updates on their credit scores as well as advice on how to strengthen their credit.

To engage and entice clients, banks can employ Instagram chatbots to deliver exclusive promotions and special offers on banking products and services.

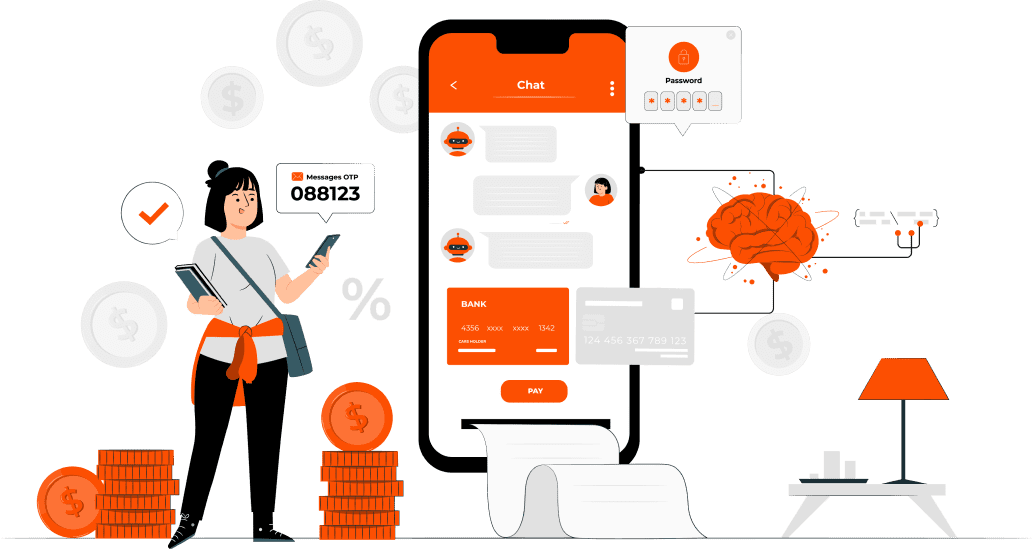

Users can use Instagram chat to conveniently check their account balances and learn more about recent transactions.

Users can start loan applications straight through Instagram with the help of chatbots, which provide information on loans, eligibility requirements, and interest rates.

The chatbot interface makes it easy for users to update their contact information, profile information, and notification choices.

Through surveys run by chatbots on Instagram, banks can obtain insightful client feedback.

Using their current location or search parameters, chatbots help consumers locate local bank branches and ATMs.

Business Benefits of Gen AI Powered Banking

chatbots on Instagram

Elevated Customer Satisfaction

Our Instagram banking chatbots powered by Generative AI provide swift responses to user inquiries and facilitate knowledge sharing through engaging content, resulting in heightened customer retention and an improved satisfaction index.

Elevated Customer Satisfaction

Our Instagram banking chatbots powered by Generative AI provide swift responses to user inquiries and facilitate knowledge sharing through engaging content, resulting in heightened customer retention and an improved satisfaction index.

Increased Return on Investment (ROI)

The versatile capabilities of our Instagram banking chatbot streamline marketing efforts, generating top-quality leads and effectively converting your followers into valued customers.

Increased Return on Investment (ROI)

The versatile capabilities of our Instagram banking chatbot streamline marketing efforts, generating top-quality leads and effectively converting your followers into valued customers.

Conclusion

According to the insightful projections of Juniper Research, the integration of Generative AI powered chatbots holds the potential to bring about substantial reductions in global business operational costs. By the year 2023, these cost savings could reach a remarkable figure of up to $7 billion. This estimate becomes even more compelling when considered alongside Accenture’s findings, which indicate that Generative AI powered chatbots could contribute an impressive $1.2 trillion in added value to the financial sector by 2035.

Why start from scratch when you can fine-tune your approach?

We provide a wide range of carefully crafted pre-built chatbot solutions for a variety of platforms like Instagram, designed to simplify and accelerate the automation process for your Instagram banking needs. These pre-built chatbot solutions cover a broad spectrum of tasks, including everything from basic tasks like creating new accounts to more complex processes like handling loan applications and credit card transactions.What’s even more remarkable is that each of our pre-built chatbot solutions can be easily tailored to align perfectly with your bank’s unique requirements and complex use cases, ensuring an ideal fit for your specific Instagram banking needs.

Frequently Asked Questions

A banking chatbot on Instagram is a computer program designed to simulate human conversation and interact with users on the Instagram platform to provide banking-related information and services.

Quick Responses, 24/7 support and high operational costs are some of the critical challenges faced by banks. Leveraging banking chatbots on Instagram can help in overcoming these challenges effectively.

Yes, you can seamlessly transition from virtual agent to human agent if the query is complex and the chatbot is unable to answer it or if you are not satisfied with the chatbot’s response, you can escalate your conversation to a human agent seamlessly.

Banking chatbots on Instagram can offer a range of services, including checking your account balance, transferring funds, locating ATMs or branches, answering frequently asked questions, and providing general account information.

Our chatbot’s plug-and-play architecture provides users with the flexibility to choose the AI technology that best aligns with their requirements and organizational goals, whether it’s Language Model (LLM) or another Generative AI platform. We leverage world-class Natural Language Processing (NLP) technologies such as IBM Watson, Google DialogFlow, Amazon Lex, Microsoft CLU, Copilot, Power Virtual Agents, and Wit.ai, tailoring our selection to meet user needs. These chosen NLP technologies are seamlessly integrated with leading Generative AI platforms such as GPT on Microsoft Azure, Watsonx, Google Gemini, Amazon BedRock, AWS SageMaker, and more, ensuring enterprises receive a premium Generative AI experience.

Ready to elevate your banking

services with Instagram chatbots?

Get started with our pre-built chatbot solutions today to enhancecustomer engagement, streamline processes, and boost efficiency.

Contact us now to explore the possibilities and transform your

Instagram banking experience! Get in touch with us now!