Elevate Your Retail Banking Experience with Generative AI Powered Virtual Assistants

Retail banking is a part of our daily lives, and in the fast-evolving banking world, ensuring smooth

customer experiences while optimizing operational efficiency is paramount. One significant challenge

is the persistent backlog of unresolved customer complaints, with just 49% resolved

in initial

interactions. This incomplete resolution can lead to dissatisfaction and deepen mistrust as these

issues persist throughout the customer journey. Currently, around 68% of customer

service agents are

struggling to handle the high volume of customer requests as per Statista’s report.

To resolve this, many banks have shifted towards AI-powered virtual assistants. These AI powered

conversational interfaces have made strides in addressing this challenge, automating responses

to

routine inquiries to some extent. But their widespread adoption has been limited due to

their limited

capabilities, especially when handling intricate and double questions. Enter Generative AI-powered

retail banking chatbots, the ultimate savior. These advanced chatbots leverage the power of Generative

AI to engage in natural, context-aware conversations, providing customers with personalized

and

comprehensive support. Their ability to understand and respond to intricate banking

inquiries, coupled

with continuous learning and improvement, make them the future of customer service in the retail

banking sector. With Generative AI-powered chatbots, banks can bridge the gap between customer

expectations and the capabilities of AI, revolutionizing the customer experience.

In this discussion, we will uncover what Generative AI-powered retail banking chatbots bring to the table and how they set themselves apart from traditional chatbots.

In this discussion, we will uncover what Generative AI-powered retail banking chatbots bring to the table and how they set themselves apart from traditional chatbots.

Let’s first understand the difference

|

Aspect

|

Traditional chatbots

|

Generative AI chatbots

|

|---|---|---|

Response Generation Response Generation |

Pre-defined, rule-based Pre-defined, rule-based |

Dynamic, context-aware Dynamic, context-aware |

Interaction Complexity Interaction Complexity |

Limited, basic queries Limited, basic queries |

Complex, nuanced dialog Complex, nuanced dialog |

Personalization Personalization |

Limited personalization Limited personalization |

Highly personalized Highly personalized |

Learning & Adaptation Learning & Adaptation |

Minimal learning Minimal learning |

Rule-based systems Rule-based systems |

Handling Complex Queries Handling Complex Queries |

Struggles with complexity Struggles with complexity |

Handles complexity well Handles complexity well |

Language Processing Language Processing |

NLP capabilities Only NLP capabilities Only |

Advanced NLP capabilities + latest LLMs Support Advanced NLP capabilities + latest LLMs Support |

Customer Engagement Customer Engagement |

Moderate engagement Moderate engagement |

Enhanced engagement Enhanced engagement |

Problem-Solving Capability Problem-Solving Capability |

Limited problem-solving Limited problem-solving |

Effective problem-solving Effective problem-solving |

Automation Efficiency Automation Efficiency |

Partial automation Partial automation |

High automation High automation |

Customer Experience Customer Experience |

Basic customer experience Basic customer experience |

Enhanced customer experience Enhanced customer experience |

Integration with Systems Integration with Systems |

Limited integration Limited integration |

Robust system integration Robust system integration |

Data Security Data Security |

Basic security measures Basic security measures |

Enhanced data security Enhanced data security |

Do you know?

- A study conducted by Juniper Research indicates that chatbots have the potential to reduce the time spent on each customer inquiry by 4 minutes, resulting in cost savings ranging from $0.50 to $0.70 per interaction. – Juniper

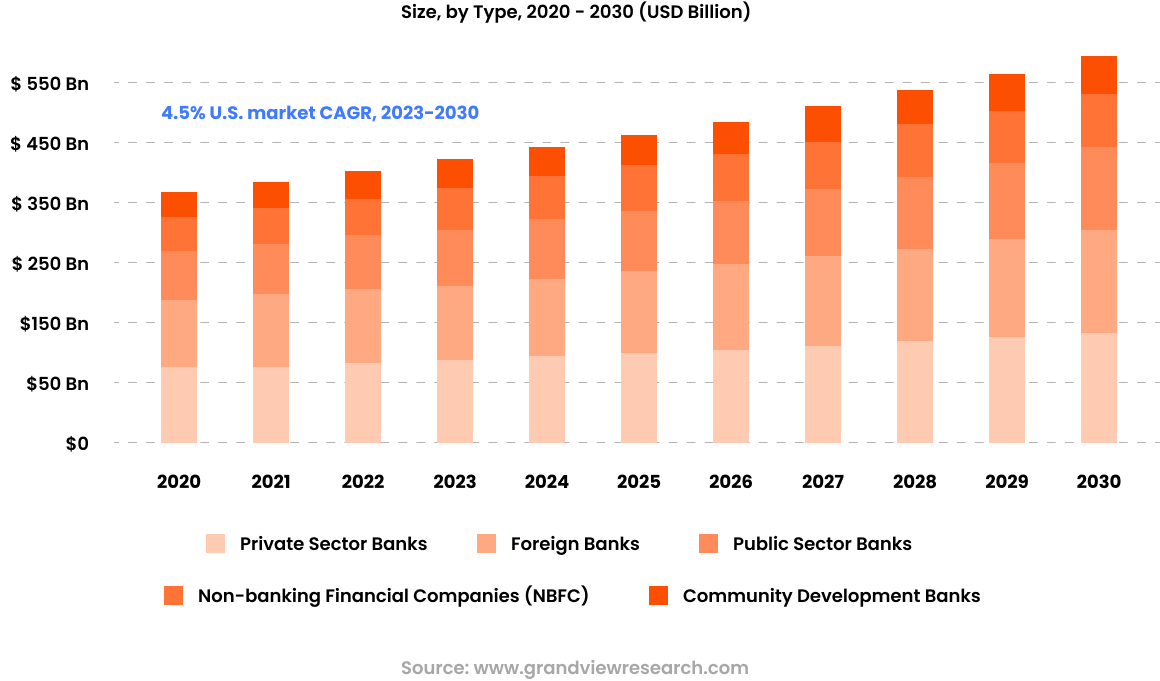

- The global retail banking market size was valued at USD 1,840.77 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030.

U.S. Retail Banking Market

What can Generative AI powered Virtual Assistants do for Retail Banking Sector?

Generative AI technologies, driven by advancements in deep learning, LLMs and natural language

processing, have ushered in a new era for the banking industry. They have acted as

catalysts for the widespread adoption of digital platforms in the banking sector. Customers now have

the convenience of conducting a wide range of financial activities online, from checking

balances and transferring funds to applying for loans and receiving personalized financial

advice. The availability of these digital services, supported by Generative AI and LLMs,

has not only improved customer satisfaction but has also reduced operational costs for

banks.

Today numerous ChatGPT-like chatbots can be found online, all professing to offer Generative AI-driven

experiences. However, the reality is that only a select few of these chatbots prove genuinely

productive and achieve widespread adoption.

The key differentiator lies in their capacity to seamlessly integrate Generative AI capabilities into banking operations, minimizing disruption, and optimizing Return on Investment (ROI) while maintaining an exceptional accuracy rate. This level of quality in a chatbot product necessitates the expertise of a seasoned team of consultants and agile AI engineers, all driven by a commitment to AI excellence.

The key differentiator lies in their capacity to seamlessly integrate Generative AI capabilities into banking operations, minimizing disruption, and optimizing Return on Investment (ROI) while maintaining an exceptional accuracy rate. This level of quality in a chatbot product necessitates the expertise of a seasoned team of consultants and agile AI engineers, all driven by a commitment to AI excellence.

How Do AI-Powered Bots Enhance Customer Experience in Retail Banking?

Introducing Streebo’s Generative AI-powered chatbot – Your Ultimate Solution for Retail Banking

Our expert team of consultants and AI engineers brings years of experience to the table, ensuring that

your retail banking operations not only stay efficient but thrive with AI excellence. Our advanced

chatbot architecture is meticulously designed to cater specifically to the needs of retail banks,

affording them the flexibility to handpick the most suitable Large Language Model (LLM) or AI

technologies such as GPT on Microsoft Azure, IBM Watsonx, AWS SageMaker, Amazon

BedRock and Google Gemini, that aligns seamlessly with their unique requirements. At the

core of our state-of-the-art conversational AI solution lies leading NLP technologies,

including IBM Watson, Amazon Lex, Microsoft CLU, Copilot, Power Virtual Agents, Google DialogFlow, and Wit.AI from

Meta harnessing the very latest advancements in the field.

In collaboration with esteemed open-source platforms such as HuggingFace, Anthropic, and

Cohere, we harness the capabilities of cutting-edge AI technologies, offering a diverse

array of invaluable experiences. Through the seamless integration of Generative AI into retail banking

operations, powered by enterprise-grade cloud platforms like IBM Cloud, Azure, AWS, or GCP, we

empower retail banks to unlock the transformative potential of AI.

Our Generative AI and Large Language Model (LLM)-powered retail banking chatbots efficiently optimize processes such as customer service, transaction management, and agent support resulting in heightened overall efficiency and productivity for retail banks. They are pre-integrated with a wide variety of Core Banking softwares such as EdgeVerve Finacle, Oracle FLEXCUBE Core Banking, and SAP Core Banking Services among others.

Our Generative AI and Large Language Model (LLM)-powered retail banking chatbots efficiently optimize processes such as customer service, transaction management, and agent support resulting in heightened overall efficiency and productivity for retail banks. They are pre-integrated with a wide variety of Core Banking softwares such as EdgeVerve Finacle, Oracle FLEXCUBE Core Banking, and SAP Core Banking Services among others.

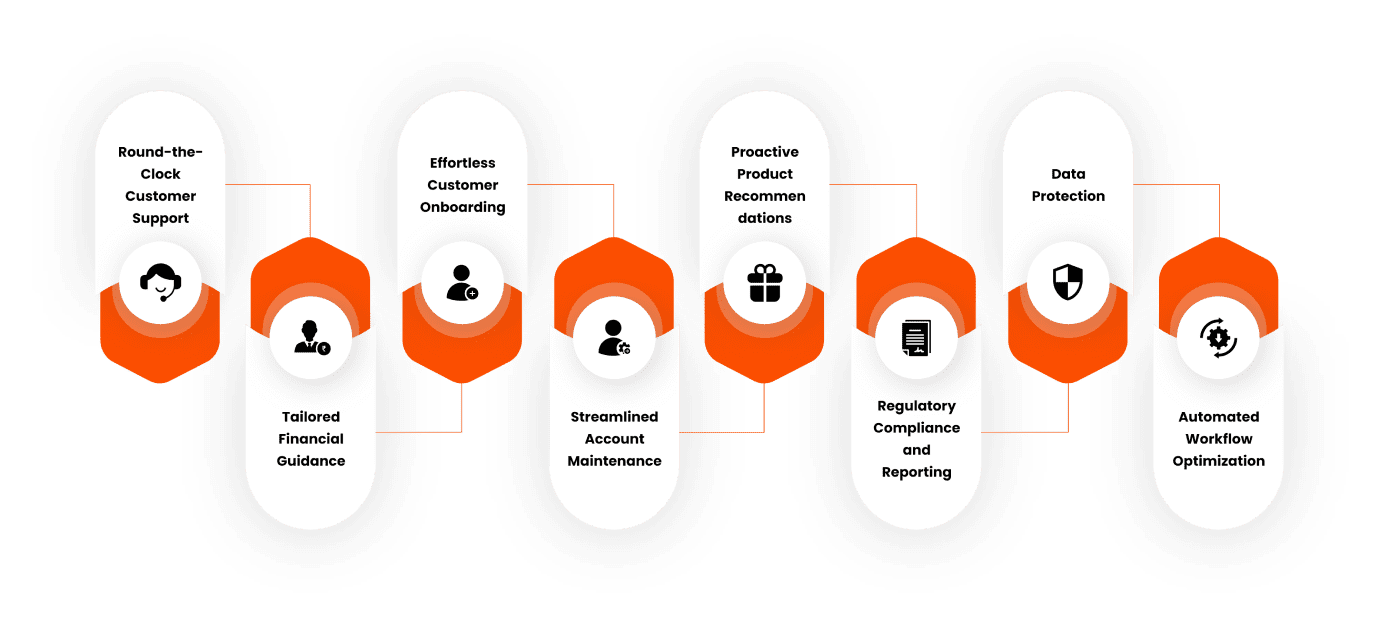

Exploring the Efficacy of Our Retail Banking chatbots

Provide constant availability for addressing customer inquiries.

Deliver personalized advice by analyzing individual financial data.

Simplify the process of setting up new customer accounts.

Assist with routine tasks related to customer accounts.

Suggest relevant products or services to customers.

Ensure strict adherence to banking regulations and generate compliance reports.

Utilize advanced security measures to safeguard customer data.

Increase internal operational efficiency by automating routine tasks.

Our NLP + Generative AI powered Retail Banking chatbots are trained in the following Retail Operations

- FAQs (Frequently Asked Questions)

- Branch Locator

- Browse Products Details

- Manage Service Request

- Customer Support and Query Resolution

- Underwriting

- Update Profile

- Worklist Management

- Offers and Promotions

- Generate a Quote

- Apply for a Loan

- Create an Account

- Track status of Loan Account

- Payment and Repayment Transactions

- Settlements

- Document Upload

- Feedbacks and Reviews

- Smart Assist – Product Recommendations based on Credit Scores

Key differentiators of Streebo’s Pre-Trained and Pre-integrated Generative AI-powered Retail Banking Bots

Streebo’s team possesses extensive domain expertise and implements exceptionally intelligent pre-trained Retail Banking Bots. These bots are adept at replicating the intricate business processes of diverse Retail Banks.

Our Generative AI powered retail banking chatbots can be deployed across social media channels such as FB Messenger, WhatsApp, WeChat, Skype, Email, Google Chat and even SMS. They can even handle voice channels such as IVR, Amazon Alexa, and Google Home.

Our Conversational AI Retail Banking Virtual Assistant can be implemented either on-site or hosted on prominent cloud platforms such as IBM Cloud, Microsoft Azure, Amazon AWS, or Google Cloud Platform.

Our ChatGPT-like bots designed for retail banks undergo ongoing training using extensive datasets until they achieve a remarkable accuracy level of 99%.

Our Retail Banking Bot comes in pre-integrated with Core Banking Solutions such as EdgeVerve Finacle, Oracle FLEXCUBE Core Banking and SAP Core Banking Services among others.

Streebo’s analytics dashboard is developed to record and display systemic data, metrics, preferences, and trends which eventually help in monitoring user interactions, and can be adapted accordingly to give relevant responses and take business decisions.

Our retail banking bot is equipped with the ability to access and process unstructured data efficiently. It can seamlessly gather information from various sources, including text documents, emails, and even voice recordings. This capability ensures that the bot can comprehensively analyze a wide range of data types, making it a valuable tool for extracting insights from diverse information sources.

Our retail banking bot excels in data classification tasks. It can automatically categorize and organize data into relevant groups or categories, making it easier for banks to manage and utilize their vast data repositories. This feature simplifies the process of retrieving specific information and enhances the overall efficiency of data management within the banking environment.

The retail banking bot is designed with multimodal capabilities, enabling it to process information from multiple sources simultaneously. It can handle text, images, audio, and video data, making it adaptable to a wide range of customer interactions. This versatility allows for a richer and more engaging customer experience, as well as improved efficiency in addressing customer inquiries and issues.

Data security is of paramount importance in the banking sector, and our retail banking bot prioritizes this aspect. It adheres to robust data security protocols to safeguard sensitive customer information. Our chatbot’s architecture includes encryption, access controls, and regular security updates to ensure that customer data remains protected.

Our retail banking bot seamlessly integrates with live agent support. This feature ensures a smooth transition from automated interactions to human assistance, allowing customers to escalate their inquiries or issues to a human agent for personalized assistance.

Business Benefits of Generative AI Powered Retail Banking chatbots

5-10%.

by 15-20%.

Pricing Options

You can choose to buy the Bot solution.

You can choose to Subscribe to our Bot solution for a fixed monthly charge with no upfront setup fee.

This is a conversation-based subscription and tied to the number of conversations & messages the bot handles. Thus, you only pay if the Bot is getting used and is actually deflecting calls.

Ready to experience

the retail

banking chatbots’ Generative

AI power?

Begin your 30-day free trial now and witness the power of ourRetail Banking chatbots fueled by Generative AI firsthand. Try

before you buy!

Reach out to us today to begin your journey.