Old World

In the old world, our Customer, a Life Insurance Provider conducted its customer interactions via:

- Branch and Head Offices – 1400 Branch Offices

- Call Center – 950 Personnel

- A Matured Web Portal and Mobile App

- Field Agents – 6500 Personnel (Independent and Captive)

The Insurance Company’s forward-looking leadership team chose to invest in IT and bring Artificial Intelligence (AI) to the game to outsmart the competition. In conjunction with Streebo & IBM, they employed a Smart chatbot for Life Insurance. Prior to the launch IBM & Streebo team trained the chatbot on various back-end systems at the insurance company including Genelco & IBM’s AS/400 and showed it how to fetch information from various siloed systems in a secured, yet scalable fashion. Powered by IBM Watson Assistant, the leading Natural Language Processing (NLP) engine (as per Gartner and Forrestor report of 2022), Streebo’s Smart chatbot was Trained until 99% Accurate, meaning it would answer at least 99 out of 100 questions correctly.

The Streebo Smart chatbot for Life Insurance was added to the workforce after a few rounds of evaluation. The chatbot was trained in various life insurance functions such as

- Generating a quote

- Paying the Premium

- Settlements

- Purchasing Policy

- Claims

- Many More

In a single stroke, the Life Insurance Provider had expanded its outreach to new social media channels and put in a smart and highly intelligent employee in place to manage the first line of interaction. The blog below captures the customer journey in the new world after the chatbot was put in place.

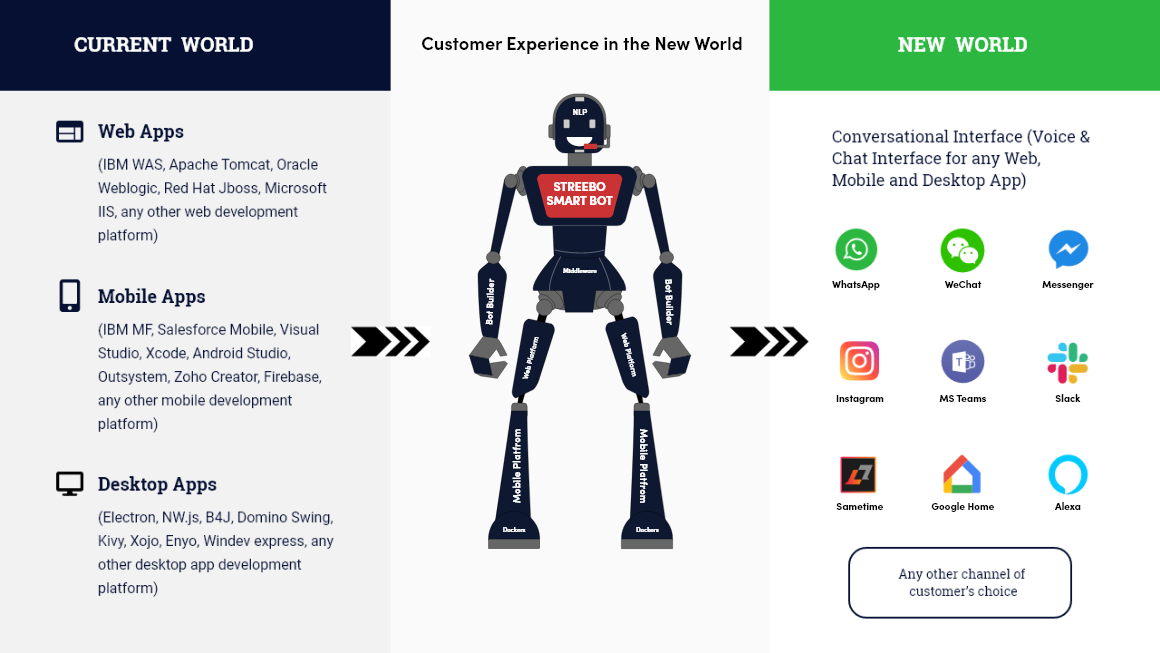

Customer Experience in the New World

Given the past Covid experience, John, and his wife have been thinking of buying a Life Insurance policy for a while now. On one of the weekends, John was browsing through Facebook; and he comes across an advertisement by a Life Insurance Company about the launch of a new Life Insurance Policy. He clicks on the ad and that in turn brings him to the Website of the company and wants to learn more about the specific product.

The Initial Interaction and Awareness through WebApp

On the website, the Life Insurance Company has deployed an AI Powered chatbot. The chatbot greets John, then John put his requirement about a life insurance policy and the bot replied with the available policy plans. While interacting, John makes some spelling mistakes, but the smart bot understands the rephrased question – further, it even ignores the spelling mistake done – all this happened because of a smart NLP engine under the covers.

John asks for details on one of the policies and the bot in turn fetches more details about the policy from the legacy system. John clicks on the View Brochure option, he reads the policy details and requests the bot to get a quote for the selected policy. Bot asks for a few required details and John shares the same. John in the middle of the conversation plans to check out the branch location in his city to see if he can schedule an in-person visit. The bot gets a high level quote for John and he is now ready to discuss details with his trusted confidants.

John asks for details on one of the policies and the bot in turn fetches more details about the policy from the legacy system. John clicks on the View Brochure option, he reads the policy details and requests the bot to get a quote for the selected policy. Bot asks for a few required details and John shares the same. John in the middle of the conversation plans to check out the branch location in his city to see if he can schedule an in-person visit. The bot gets a high level quote for John and he is now ready to discuss details with his trusted confidants.

Query Resolution on WhatsApp

The next day in the office John was discussing the quote generated yesterday with his colleague Smith. who in turn asked John to check regarding the claim settlement ratio and time required for the same. He sends his query on the number available in the quote over the WhatsApp channel.

To his pleasant surprise, he receives an instant response thanks to the Life Insurance chatbot also available on WhatsApp. The bot responds with the claim settlement report PDF along with a manual that describes the assistance provided at the time of the claim settlement. He is delighted to see the instant response.

To his pleasant surprise, he receives an instant response thanks to the Life Insurance chatbot also available on WhatsApp. The bot responds with the claim settlement report PDF along with a manual that describes the assistance provided at the time of the claim settlement. He is delighted to see the instant response.

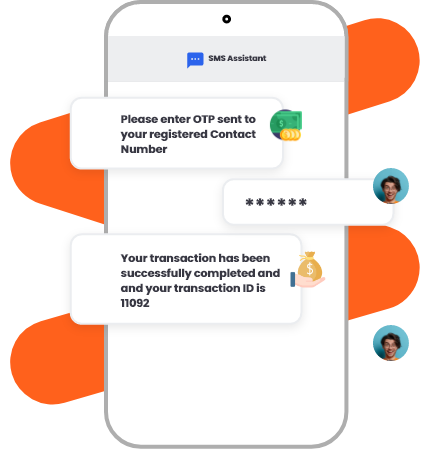

The Seamless Purchase Through SMS

Post the quote inquiry and resolving all doubts he schedules an appointment with one of the agents over the chatbot available on WhatsApp. One of the Agents contacts John and he now completes the process to buy the policy. He submits all the documents to the company via the app.

Now, he just needs to make the payment for the policy. Upon verification of the documents submitted, John gets an SMS to make the payment. He opens the SMS and is impressed to see instant responses as this channel is also manned by a bot. John now starts the process to make payments.

The Bot walks John step by step with the required information & payment method and completes the transaction in a secured manner. The bot displays a payment completion message and shows transaction ID and closes the transaction and sends the policy for approval.

Now, he just needs to make the payment for the policy. Upon verification of the documents submitted, John gets an SMS to make the payment. He opens the SMS and is impressed to see instant responses as this channel is also manned by a bot. John now starts the process to make payments.

The Bot walks John step by step with the required information & payment method and completes the transaction in a secured manner. The bot displays a payment completion message and shows transaction ID and closes the transaction and sends the policy for approval.

Updates & Notification using Mobile App

After a few days, John wanted to track his policy approval status. He recalls that the company also has deployed a Bot on their Mobile App. He opens the Mobile app Bot and starts the conversation.

John enters the policy number to check the approval status and receives a response from the bot that his policy is now approved.

John shortly hereafter receives an email containing details such as the Policy Number and others with an attached PDF of the Policy thus making him a happy customer.

John enters the policy number to check the approval status and receives a response from the bot that his policy is now approved.

John shortly hereafter receives an email containing details such as the Policy Number and others with an attached PDF of the Policy thus making him a happy customer.

Click here to learn more about Streebo Smart Life Insurance chatbots

Pricing Options

MVP(Minimum Viable Product) bot includes:

3 transaction used cases.

3 transaction used cases. 1 backend integrations

1 backend integrations 50 FAQ’s

50 FAQ’s Channels – Web, Mobile App, 1 Social media channel such as WhatsApp/Facebook messenger.

Channels – Web, Mobile App, 1 Social media channel such as WhatsApp/Facebook messenger.Capex Option

You can choose to buy the MVP Bot.

You can choose to buy the MVP Bot.Opex Option

You can choose to Subscribe to the MVP Bot for a fixed monthly charge with no upfront setup fee.

You can choose to Subscribe to the MVP Bot for a fixed monthly charge with no upfront setup fee.Pay Per Usage

This is a conversation -based subscription and tied to the number of conversations & messages the bot handles. Thus you only pay if the Bot is getting used and is actually deflecting calls.

This is a conversation -based subscription and tied to the number of conversations & messages the bot handles. Thus you only pay if the Bot is getting used and is actually deflecting calls.Get in touch with our SME to know more about Streebo Smart Bots for Life Insurance Customers.

Schedule a demo